Davos this year coincides with the 50th birthday of the World Economic Forum (WEF). So Gillian Tett, under the FT’s Moral Money series, chose this opportunity to ask its founder, Klaus Schwab, a list of fundamental questions about the relevance of WEF’s annual show. In the face of mounting global problems these questions are increasingly urgent and yet fiendishly intractable. Or, to paraphrase Tett, has Davos always been more of a talking shop than the crucible now required to transition business to a stakeholder value system that moves us beyond the Friedman form of capitalism?

The WEF has used this year’s Davos event to launch its own attempt at producing a set of recommended metrics for sustainability reporting. These have been designed in collaboration with the Big 4 accounting firms, purportedly to create a reporting framework that moves companies towards a comparative standard that will enable them to present their credentials for societal impact and responsibility. In this respect, it joins the plethora of initiatives seeking a similar goal.

Unfortunately though, it has chosen to adopt a conventional accounting lens that has distorted the image of company performance and value for far too long. It has also bundled together seemingly desirable outcome measures, largely from disparate existing reporting approaches, that have not been melded together with any coherence. The set of metrics is fragmented and, while some of them might have their own use in isolation, many are nonsensical and do not adhere to the Maturity Institute’s core principle that metrics only carry meaning if they are causally connected to value and risk. For example, reporting on training and R&D activities, rather than value actually created. Overall, they offer no holistic, overarching linkage with the corporation’s whole system of value generation, nor all of its stakeholders.

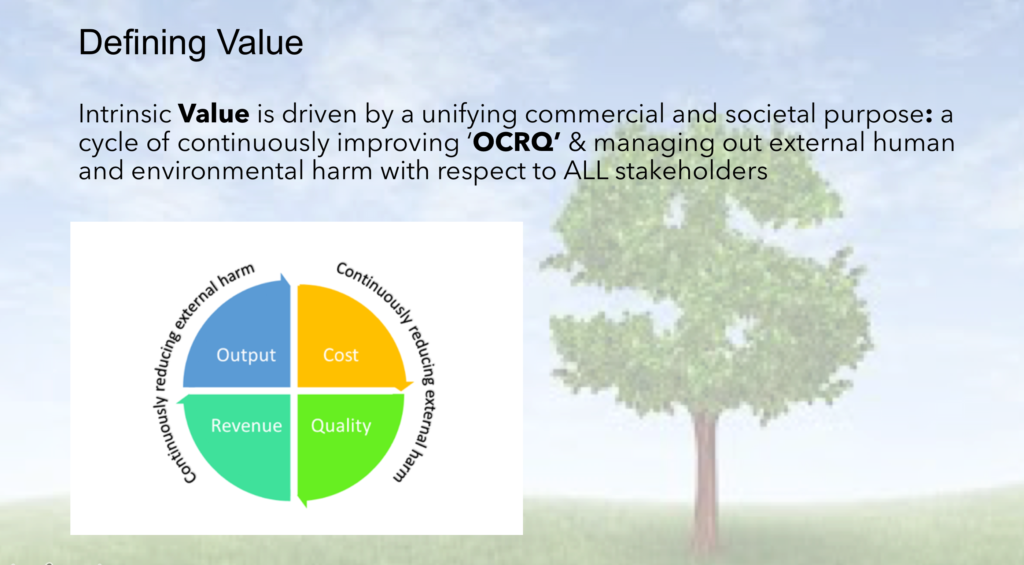

The Maturity Institute has only been established since 2012 but it has already delivered on its main “manifesto” goal of setting up a system of Total Stakeholder Value that is already being measured in real time (see ‘The Mature Corporation – A Model of Responsible Capitalism’). We defined our terms very precisely, especially the crucial term ‘value’ in a way that incorporates the impact and damage that we are all inflicting upon humanity and the environment.

We are already working with the finance and investment communities to translate clear, commercial decisions into responsible investments. We have advised US Business Roundtable members (who may well be at Davos) that, if they want to prove they are really serving the interests of all stakeholders, they will have to measure their own Total Stakeholder Value. Only then will they demonstrate that they are delivering value to each one, including shareholders, and be able to justify the distribution of rewards accordingly – including pay to senior executives.

The Maturity Institute is not an elite. We are a group of dedicated, evidence-based, professional, management practitioners. We have a vocation equivalent to the medical profession and set ourselves the very highest, global standards for business integrity. We also turn our talk into action.

If you would like to find out about how our work is being used by companies, investment professionals and academia, please contact paul.kearns@maturityinstitute.com

Comments are closed