We may all struggle to find any positives among the devastation wreaked by Covid; yet 2020 proved to be the most important year in MI’s history and one that offers greater hopes for us all. First, the pandemic keeps reminding us just how much we are all part of one, whole, global system of humanity. We all need to look after each other because it is in our own best interests and so we have to view it as a very positive, long-term, virtuous cycle of continuous improvement: this is MI’s philosophy.

Second, the attitudes, actions and behaviours of corporations are shifting. Our own work demonstrates, through evidence-based measurement, just how much the changing expectations of society are forcing change in corporate purpose; epitomized by AstraZeneca’s response in providing developing countries with cheap vaccinations. This is the modus operandi of the Maturity Institute, truly responsible capitalism – or what is now often referred to as the necessary integration of ‘ESG’ into corporate strategy.

One of the biggest barriers to ESG, up to now, has been the erroneous belief that it requires a trade-off between profit and social responsibility. This stance has been adopted by conventionally-minded corporations, investors and business commentators, to argue that ESG comes at the expense of shareholder value. This is not true. The conviction of our rebuttal can be seen in the growing body of evidence, compiled by MI, through our company ratings (OMRs) that comprise the official OMINDEX®.

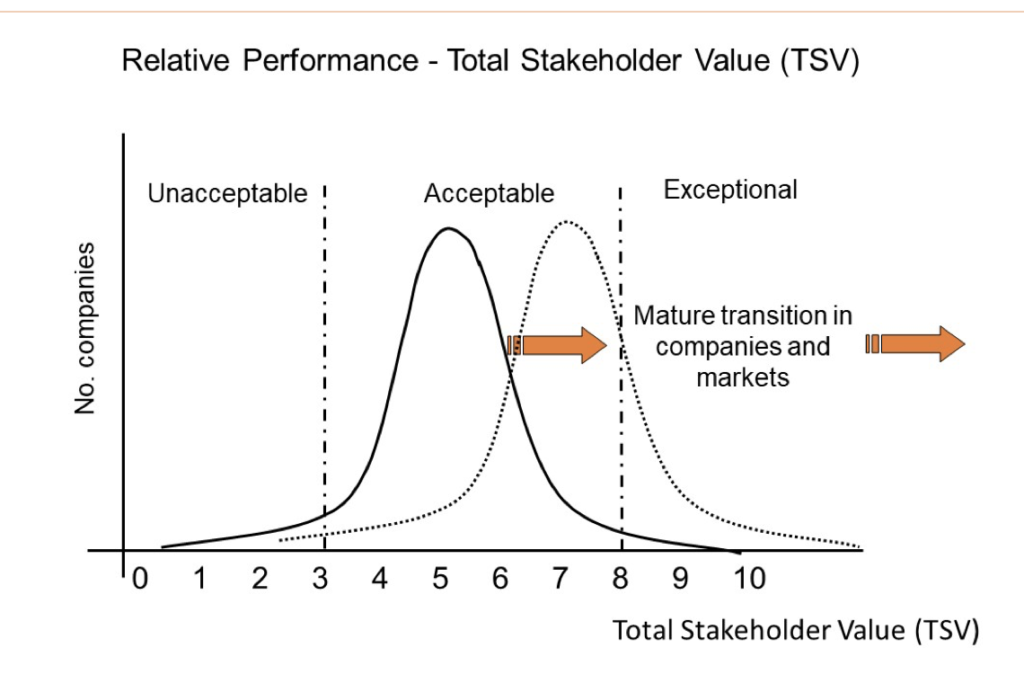

Organizations can only best serve all their stakeholders, including shareholders, by authentically serving society; pursuing a purpose rooted in creating what we call Total Stakeholder Value (TSV). Corporations with an authentic and coherent ESG strategy are already being measured on OMINDEX® and achieve a favourable comparison with competitors who retain business models predicated on the principle of ‘shareholder primacy’. OMINDEX® marks out a race for the top, where the very best companies fully reconcile responsible business with outperformance; aligning all stakeholders to realise the best possible value.

MI set out in 2012 to become the leading professional management institution for ESG readiness; in the never-ending pursuit of TSV. Our work within academia, corporations and professional investment firms; and our recent project alliance with Redburn (Europe) Limited, to use the OMINDEX® methodology (producing a large, MI-trained cohort of financially qualified equity analysts), has shown how to transform the way we all do business.

Mature company research, analysis and management practice can now assimilate a much deeper assessment of corporate willingness to transform; following a clear, diagnostic roadmap. Especially exciting is the ability of OMINDEX® to capture the crucial, corporate ‘intangibles’ (e.g. culture, trust, learning, innovation and employee empowerment) while integrating them with conventional, financial measures, long-term performance indicators and company reporting.

MI is now in the position to comprehensively train and empower corporate executives and the full range of professionals (corporate advisory, legal, accounting, risk management – see MI Exec Ed: OMINDEX® Standard for ESG Management) who can install and operationalize OMINDEX® as part of their own professional practice. The reports it can produce are designed to help organisations navigate the complexities of fiduciary duty, regulatory oversight and the creation of mutually inclusive, Total Stakeholder Value (*see technical note below).

For further details please contact stuart.woollard@omservices.org

Technical note:

In the UK, for example, corporate governance includes director’s duties set out under the UK Companies Act (2006). The UK’s Institute of Directors provides commentary as follows:

With regard to the specific wording of Section 172:

1. MI’s OMINDEX® specifically aims to benefit all stakeholders, including members (shareholders)

2. In Clause (1) (a) to (f), all of these items are already incorporated into the OMINDEX® methodology.

3. Scoring against Question 1 of the OMINDEX® methodology demands a clear statement of purpose that is in the interests of Total Stakeholder value

In 2015, OMINDEX® data was requested as part of the work to launch the IoD’s Good Governance Index. In 2019 we engaged with Charlotte Valeur, then IoD Chair, and worked through the OM30 (OMINDEX) measurement questionnaire. She immediately saw it as directly relevant for the role of company directors today. The advice currently on the IoD website is available via the above link, while Section 172 of the Companies Act 2006 states: –

“Duty to promote the success of the company

(1) A director of a company must act in the way (s)he considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole, and in doing so have regard (amongst other matters) to—

(a) the likely consequences of any decision in the long term,

(b) the interests of the company’s employees,

(c) the need to foster the company’s business relationships with suppliers, customers and others,

(d) the impact of the company’s operations on the community and the environment,

(e) the desirability of the company maintaining a reputation for high standards of business conduct, and

(f) the need to act fairly as between members of the company.

(2) Where or to the extent that the purposes of the company consist of or include purposes other than the benefit of its members, subsection (1) has effect as if the reference to promoting the success of the company for the benefit of its members were to achieving those purposes.

(3) The duty imposed by this section has effect subject to any enactment or rule of law requiring directors, in certain circumstances, to consider or act in the interests of creditors of the company.

Comments are closed