London – 24 February 2015: The Maturity Institute in partnership with OMS LLP and supported by Long Finance releases the first Organization Maturity Index for its first 12 corporations.

London – 24 February 2015: The Maturity Institute in partnership with OMS LLP and supported by Long Finance releases the first Organization Maturity Index for its first 12 corporations.

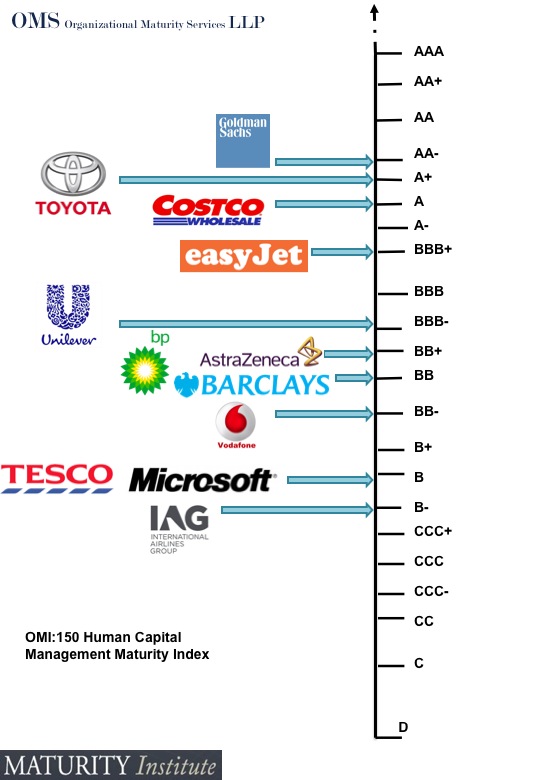

The OMI:150 is the world’s first index that identifies the extent to which firms are able to generate business value and mitigate risk with respect to their human capital.

Measured against the research tested maturity framework of the Maturity Institute, the OMI:150 uses OMS LLP’s proprietary methodology to assign an Organization Maturity Rating (OMR) according to OMS’ rating scale using AAA categorization.

What is an OMR?

After over 20 years in development, Organizational Maturity Rating (OMR) is a highly sophisticated methodology that gets under the organizational ‘skin’ and offers an analytical perspective to complement conventional financial and investment analysis. It is designed specifically for the purpose of assessing the extent to which an organization has the human capital management (HCM) capability to achieve the most sustainable competitive advantage and market value. OMR views the value potential of a corporation from two distinct perspectives: –

- Market value: both step change, through innovation, and incremental improvements measured by way of specific reference to baseline improvements in the four key variables of Output (O), Costs (C), Revenue (R) and Quality (Q) of product and/or service.

- Operational Risk: the probability of significant business risk attributable to ineffective HCM.

A company may be producing relatively high financial returns based on conventional criteria (EBITDA, ROCE, RONA etc.). OMR identifies additional value creation opportunities that arise from greater integration of HCM, business strategy and operational planning. An OMR captures a whole system view of the organization with discernible links to value creation and risk.

The methodology that underpins OMR covers the key criteria for determining the quality of leadership and management capability with respect to HCM. Markets will change, economic cycles will come and go and business models may have a natural life cycle but organizational maturity analysis identifies underlying fundamentals for sustainable value generation. Where these are in place the organization will gain competitive advantage through adaptability and agility. Where effective HCM is absent the organization will be susceptible to instability, risk and long-term value erosion. The OMR approach is therefore designed as a reliable and predictive indicator of relative competitive advantage and future performance.

The world’s first OMR research note on Microsoft has also been produced for a leading US based asset manager and provides additional context about the ratings methodology.

Stuart Woollard, Managing Partner of OMS LLP said:

“We are delighted to be able to release the first phase of our OMR Index, which is designed for both companies to consider their own value opportunities and asset owners and managers to build this unique analysis into investment decision making.

Our aim is to make OMR a fundamental part of corporate valuation and we are very excited by the positive response received so far from companies and the investment community. We see the human capital value element as a critical missing piece of company analysis and we have finally produced a quantifiable way of measuring effectiveness in this respect. ”

ENDS

For more information, please contact Stuart Woollard at stuart.woollard@omservices.org +44 (0) 7940 585661

NOTES TO EDITORS

The Maturity Institute (www.maturityinstitute.com) is the professional body dedicated to achieving business and societal value through organization maturity and comprises a global network facilitating the creation of vibrant, healthy and successful organizations through maximizing the value of their people.

OMS LLP (www.omservices.org) is the first professional services firm to be accredited and licensed by the Maturity Institute , sharing a common aim of helping organizations to create sustained societal value through maximizing the value of their human capital.

The Long Finance (www.longfinance.net) initiative continues to encourage the development of long – term solutions for finance. Through its programmes, research agenda and publications, events and communities, Long Finance tries to expand frontiers, change systems and deliver services to foster a long-term approach to finance.

Comments are closed