It is inevitable that ESG will lead to a new, global system of value management, in time. This new management system is dependent on the right approach and measurement system for the ‘S’.

Oxford English Dictionary definition: ‘Social’ – adjective. ‘Relating to society or its organization’

ESG stands for the full range of Environmental, Social and Governance issues that have to be addressed, responsibly, when making investment decisions. In 1970, American economist Milton Friedman argued that the sole purpose of a business is to generate a profit for its shareholders. Yet making a profit is not, itself, automatically an act of a responsible human being. Anyone today, whose environment is being harmed by the actions of a profit-taking company, will acknowledge this as a fundamental principle for a cohesive society. This is why the term ‘ESG’ is now universally recognised as a necessary condition for sustaining our lives; while profit is no longer sufficient (see ‘Is the social responsibility of business to increase its profits?).

Even if the company is adhering to current regulations, or company law, adherence to the principles of ESG demands acknowledgement that there is a higher authority at play here, with greater legitimacy, the world’s entire stakeholders as one society. What makes the ‘S’ particularly complex is that we each come with our own views of our own ‘rights’ and expectations of what constitutes fair treatment and good corporate behaviour (the ‘social contract’). This is the challenge for humanity. How do we get everyone to agree on the ‘G’ of good corporate governance, for example?

From a more practical perspective, ‘Social’ has to mean how we organize ourselves. The world’s legislators are only just beginning to wake up to this fact and ‘Friedmanite’ company laws, which afford shareholders exclusive primacy, are already well past their ‘use by’ date. Any responsible board member reading this would be well advised to put this interpretation of ESG on the next agenda. This is nothing short of a completely reinvigorated form of capitalism.

The essential feature of ‘S’ is an acceptance of the perspective that the Earth, and every creature on it, constitutes a single global system. Ultimately ESG is not, and cannot be, a national debate. National politics tend to be driven by local issues because there is no global political system. Until there is, the negative effects of the present capitalist system – the ‘E’ in ESG (e.g. pollution of the seas, climate change) – are increasingly ending up on more local beaches and doorsteps in need of a whole system solution.

We are all witnessing these calamitous effects, even if we don’t feel the effects personally. So the ‘S’ is as much about perception as reality and if society thinks a company is behaving irresponsibly, it probably is. Your company is already feeling this effect and, sooner or later, it will impact on your financial performance. Those who ‘Govern’ now have to think and behave in the interests of global society, even if their business looks and feels ‘local’. In short, a company’s list of stakeholders far outweighs is registered shareholders. A monumental shift in corporate mentality and management systems is underway.

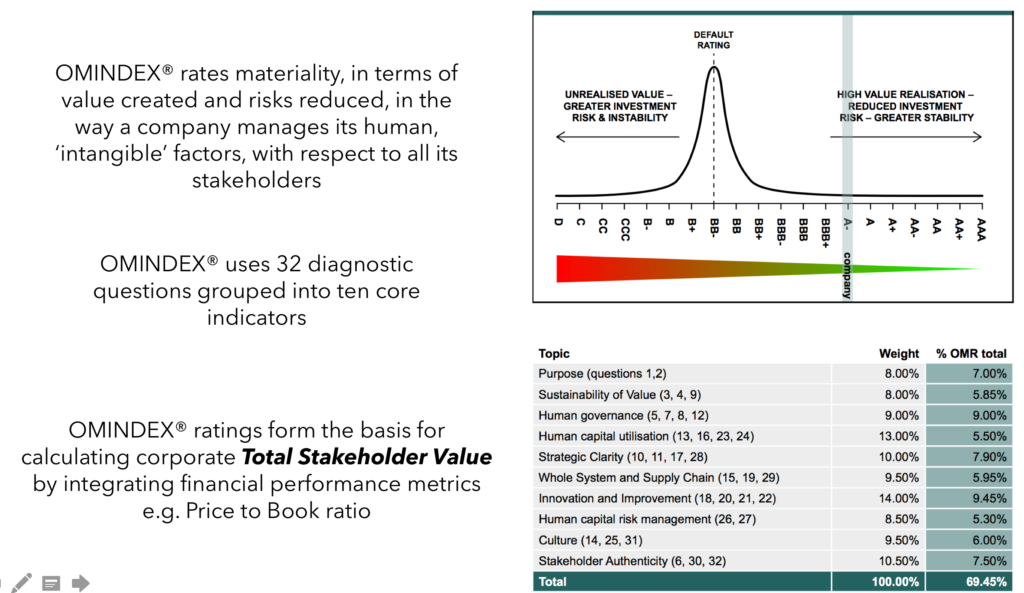

It is inevitable that ESG will lead to a ‘Global Management System’, in time. This new management system is dependent on the right measurement system for the ‘S’. The Maturity Institute (MI) was established in 2012 for this purpose. Our ultimate measure of a company’s ESG credentials is called ‘Total Stakeholder Value’ and the management system we use to rate, compare and help improve companies is called OMINDEX®. This is our global ESG standard. What’s yours?

Postcript – the day after this was posted – ‘Measuring what matters: the scramble to set standards for sustainable business‘ appeared in the Financial Times. Simplification is obviously now the biggest issue for ESG investors… and everyone on the planet.

Comments are closed