This is Part 1 in our BRT Series – see parts 2, 3, 4, 5, 6

Monday 19th August 2019 – mark it in your diary. It will forever be remembered as the day the world finally grew up, for the betterment of all humankind. It will be seen, in hindsight, as the day all of us were finally released from the shackles of the ‘Friedman Doctrine’; that put the interests of shareholders first, in the pursuit of profit. It was the day when a new “Statement on the Purpose of a Corporation” was revealed to the world. This has been signed by over 181 highly influential business leaders; all members of America’s Business Roundtable. They have declared that they all “… share a fundamental commitment to all (of our) stakeholders”. But probably much more than they yet realise. The genie is now out of the bottle.

While it is a bold statement, it is not yet a fully formed philosophy; capable of providing an alternative foundation for a new type of global, socio-economic system. It does not address any of the immediate practicalities or acknowledge the extent to which all of their business strategies will have to be fundamentally reformulated. It offers no new, valid performance measures of ‘stakeholder value’ by which these leaders are willing to be held to account (without the need for any recourse to new legislation or regulation). More importantly, they do not explain how they will get other business leaders, or investors, to become willing participants in this endeavour.

In stark contrast, the Maturity Institute warmly welcomes this statement as the beginning of a new era of enlightenment; with no reason for anyone to be cynical or shed any tears. We have the evidence that a stakeholder economy really is in everyone’s interests. This is one big win-win for the entire world but it is entirely dependent on a complete rethink of business education.

For example, when the Financial Times Editorial Board, whose primary concern has always been financial value, immediately followed the Roundtable’s lead with the heading “Business must act on a new corporate purpose”, they could be accused of tearing down a derelict edifice without having a blueprint in place for a more sustainable and socially legitimate design. Maybe nothing needs to be demolished here? This can be a very well-ordered transition as long as all the players agree on the goal and measures of progress. This applies equally to all commentators and observers; whether they reside in the business press, august publications or academic journals.

The new education starts with understanding just how much Friedman’s philosophy was based on shaky economic foundations but any new alternative, with a fighting chance of success, will have to be a model designed for the purposes of a whole global system: particularly at a time of heightened awareness of the dangers facing the entire planet. Any impact will affect us all; so any answer today has to be a systemic approach that automatically includes everyone in the default, world system.

When the founders of the Maturity Institute put their collective heads together in 2012, to address all of these complex issues, we took the epochal decision that we had to start from a crystal clear purpose of maximising the value of everyone on the planet; for the benefit of everyone on the planet. This is our definition of societal value. We were not sure how we were going to measure it but we were equally clear, in our own rationale, that it had to be measured in a way that motivated everyone to engage in the pursuit of a common purpose. Purpose and human motivation have never been totally aligned in this way before (although we have already found companies that exemplify and embody this philosophy within their own operating systems).

By 2015 we had developed the earliest version of our OMINDEX, which measures organizations against a set of 32 criteria (using our OM30 diagnostic) and covers every aspect of the totality of corporate value. We call this measure Total Stakeholder Value (TSV) and have been building our evidence base to support this thesis of whole system value ever since.

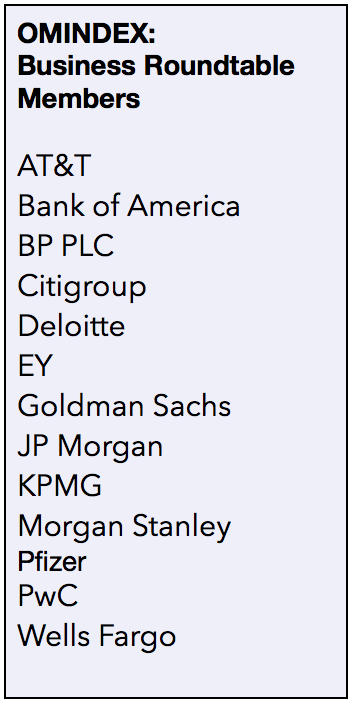

In fact, 13 of the signatory companies in the Business Roundtable (see table) have been part of OMINDEX for some considerable time, with ratings ranging from A- to BB-. The Boards of each firm here are very welcome to contact us to find out how well they have been serving their stakeholders so far. Our methodology is open source, so firms can also align themselves to the value opportunities available through our OM30 diagnostic.

If they are concerned by the advice from the FT’s Editorial Board that “Promoting longer-term interests will undoubtedly run into conflict with quarterly reporting requirements“, they need not worry. Highly mature, exemplar organizations have managed to make the short-term and the long-term a virtuous cycle rather than a vicious spiral.

For company stakeholders themselves – investors, employees, customers and wider society – the advent of a new Total Stakeholder Value paradigm should be forcefully encouraged. This new world has no downside and is simultaneously in all of their interests. In this context, The Business Roundtable has now identified its single, over-arching responsibility to society – to understand the totality of each member’s value across all societal stakeholders and to start improving their TSV from an acknowledged baseline. OMINDEX provides the baselines and measures that will show comparatve improvements over the coming years. At the same time, the evidence of increased company valuations will speak for itself.

Comments are closed