“There is a climate change component to this…but there’s also a failure of management.” said Michael W. Wara, director, climate and energy policy program at Stanford University

Pacific Gas & Electric (PG&E Corporation) came to widespread prominence in the 1990s after the company was found to have contaminated the water supply of local residents in Hinckley, California. Erin Brockovich’s dedicated efforts to force PG&E to accept accountability for its actions ended with the last settlement being made in 2008. What she could not achieve, however, was the transformation of the company’s intrinsic governance, culture and behaviour. Neither Brockovich, nor anyone, could present PG&E with a better corporate purpose, better measures of its performance for society, or better management methods to achieve benefits for all of its stakeholders.

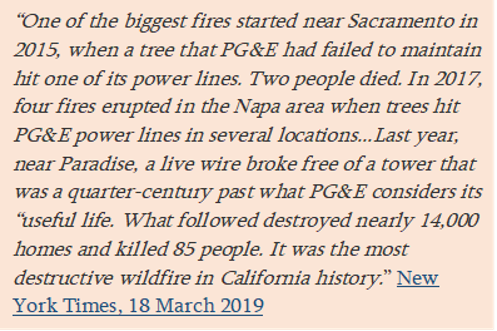

PG&E’s more recent failures to maintain both its electricity pylons and the surrounding natural environment were known by the company for some years; yet management failed to address them. PG&E’s inaction led to catastrophic damage – fatalities, environmental devastation, and astronomic financial costs. The PG&E Corporation, whose underlying purpose was to make as much profit as it could, filed for bankruptcy this year and has seen its market value plummet around 90% from a high of US$37bn. It will be a whole host of other stakeholders who will be paying P&GE’s bill for many years; including employees, pension fund holders and investors.

PG&E has had profound effects on everyone in the system, many of whom probably did not even realise that they were ‘connected’ to the company. Our own OMINDEX analysis is designed to reveal these direct, causal linkages; between the components factors within ESG, human behaviours in organizations, and the ultimate outcomes for all stakeholders within the whole system. With OMINDEX we have the means to better quantify, assess and rate such underlying risks before they manifest.

In a series of recent posts, we have explained how we deploy Organizational Maturity Ratings (OMR) to uncover the intrinsic value and risk arising from any company’s whole, human ecosystem. Our OM30 diagnostic looks at 32 inter-related factors and is able to identify and predict the likelihood of material human risk arising from critical causal drivers, such as: –

- Formulating and articulating a corporate purpose of Total Stakeholder Value (TSV) maximisation

- Identifying whether an organization’s business strategy and operating model are predicated on reconciling its (market) value with changing societal values

- Checking the extent of trust placed in the leadership and management team by customers, employees, and other key stakeholders

- Determining whether the organization is planning to maximise the value it generates from all of its human capital value (both internal and external – e.g. supply chain)

- Considering the evidence of any never-ending, continuous improvement philosophy being operationalised

In doing so society is, at last, able to gauge true corporate responsibility – to enable investors, executives and managers avoid the worst outcomes from their focus on Friedman’s profit motive, by transitioning to a corporate purpose of TSV that can be measured and monitored. Investors can also begin to price-in the previously intractable issue of ‘intangibles’ and start to understand how the ‘E’ in ESG follows on from failures in the ‘S’ and ‘G’.

MI is already using its methodology and growing evidence base to work with a number of academic institutions to help them understand the relationship between the OM30, current ESG frameworks, and equity risk. Recent academic testing of our data has shown:

“…there is very strong negative association between OMR [using our OM30 diagnostic] and all aggregated indexes of not only S, G but also E risks/incidents/controversial issues…this strong negative association remains when investigating further into each specific issue. OMR and TSV [Total Stakeholder Value] are significantly negatively correlated with ALL controversial issues.” Cambridge Judge Business School, March, 2019

PG&E is, of course, a far from isolated example. While regulators continuously react to catastrophic events through piecemeal, legal controls; rather than identifying and resolving root causes, we will all continue to witness the increasing incidence of such issues arising. At MI, we are working to help all stakeholders play their part in helping to effect the change that is now essential.

This post is part 4 in our ‘BRT’ series – see parts 1, 2, 3, 4, 5, 6

Comments are closed