The Maturity Institute’s OMINDEX® ESG standard generates the base measure for its ‘Total Stakeholder Value’ metric. With its 32-factors, it provides boards and c-suites with a foundational, whole diagnostic system for the management and creation of value; for shareholders and all other societal stakeholders, without trade off.

What is your company’s management system? It’s a simple question but one that most companies are likely to find difficult to answer. For what is a ‘value’ management system? How does your company even define value? Some companies explain what they do by reference to a set of guiding principles – the “Novo Nordisk Way”, for example, explains that its principles help it to formulate the right kind of decision making. Jeff Bezos similarly set out a number of key leadership principles at Amazon, designed to help ensure that the way he ran the company could be cascaded down the organisation. But can these be considered to be a fully formed and coherent management system?

In the latter part of the 20thCentury, much of industry (although not commerce) was introduced to Total Quality Management for the first time, together with the notion of “world class manufacturing” (based on the Toyota Production System – TPS). This was a completely new way of thinking but it could also be described as a system for management, designed to create value. The TPS worked best from a starting point where executives had to admit to themselves that they did not realise just how much they needed to learn. With the advent of ESG and stakeholder capitalism, we are in a similar place. Traditional business school teaching rooted in shareholder value and profit maximisation has influenced management decision making for over fifty years. With climate change, pollution and social inequality, companies are being forced to confront and help to solve global problems. This financially driven paradigm therefore needs replacing. Boards and c-suites must re-boot their own learning, to view organizations in terms of their ability to work as a mature, whole value system for the first time. This requires some courage, to embrace something unfamiliar and uncomfortable, but it is now necessary and urgent, to bring about systemic change.

While many were seeking to adopt a version of total quality, the Toyota Production System (TPS) was continuously developed and refined into what is commonly known today as “lean”. It has been imitated by literally thousands of firms, to varying degrees of success, but with only a few being able to fully understand and capture its human-powered essence. Toyota, in line with its own mature outlook and societal purpose, has been only too willing to engage in sharing its approach, including with competitors in many joint ventures.

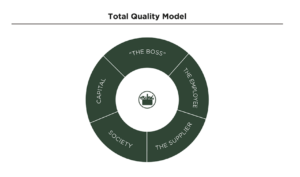

The full version of TPS can most accurately be described as a whole learning system. Toyota, like Handelsbanken and other highly rated OMINDEX® firms, understands that systems and processes can only work if they are designed to work in an essentially human context. Perhaps the best articulation of this, as a learning and management system, is conveyed by Mercadona, who in the early 1990s adopted and adapted the TPS, which it describes as a model in “constant transformation”. Since designing its Total Quality Model, this Spanish headquartered supermarket has dominated its peers in the three decades since.

“Since 1993, Mercadona has based all its decisions on its Total Quality Model, which seeks to satisfy, equally and with the same intensity, all five components of the company: “The Boss”, as the customer is internally known, the Employee, the Supplier, Society, and Capital.”

Total Value Management

Importantly, Mercadona’s TQM also presents us with an elegant Total Value Business Model. One that has solved the problem of integrating ESG, by showing how serving society while ensuring financial strength can be mutually inclusive, in fact, symbiotic. Every one of Mercadona’s five core business model (“stakeholder”) components are managed as a whole system of value.

But how can other firms simultaneously reconcile the creation of ‘value’ for both the market (i.e. shareholders) and society (all other stakeholders)? Can we all be like Mercadona? Our belief, rooted in deploying OMINDEX® and gathering compelling evidence over the last eight years, is that it is not just possible, but now essential.

The primary challenge is to shift conventional business leadership that remains underpinned by financial and economic theories that have espoused shareholder value and profit maximisation as central tenets. The advent of ESG, fortunately, presents a fundamental opportunity for paradigm change, where responsible business can no longer be an adjunct to core business strategy.

So, what can companies do next?

The Maturity Institute has re-framed business education as a new paradigm but one that draws on the critical lessons from exemplar firms. Like these firms, our universal OMINDEX® diagnostic of organisational health puts Total Stakeholder Value (TSV) at its heart; and enables ESG to be fully integrated into responsible business, investment strategy and management practice. In essence:

- OMINDEX® rates materiality; value created and risks reduced, in the way a company manages its human, ‘intangible’ factors, across all its stakeholders

- OMINDEX® uses 32 diagnostic questions grouped into ten core indicators, including Purpose, Innovation and Improvement, and Human Governance

- OMINDEX® ratings form the basis for calculating corporate Total Stakeholder Value by integrating ESG factors with financial performance metrics e.g. price to book ratio

Each company is scored against each of 32 individual factors, using defined OMINDEX® measurement scales. Diagnostic rules underpin interpretation and judgement of multiple sources of evidence that meet Maturity Institute standards. It constitutes a total management methodology that is being taught to corporate, investment and risk management professionals.

Our approach is about enabling a transition from shareholders to all stakeholders; where companies, investors, regulators and business schools can adapt current strategies and methods, to integrate them under a common purpose of Total Stakeholder Value.

If you are interested in learning about OMINDEX® and Total Stakeholder Value please contact stuart.woollard@omservices.org

Comments are closed